MIT's Office of Gift Planning is happy to speak with you about gift annuities and charitable remainder trusts and how they can be invested alongside the MIT endowment to provide income to you and/or beneficiaries.

Gift Annuities*

The MIT charitable gift annuity (CGA) is a simple contract between you and MIT, in which MIT provides a fixed annual income for one or two people for life, in exchange for a gift of $20,000 or more. Rates are based on the age(s) of the annuitant(s), and you are eligible for a partial income tax charitable deduction in the year the gift is made if you meet the itemized deduction threshold. The remainder of your gift becomes available to MIT for the specific purpose you have chosen.

*See the disclaimers for donors at the bottom of the webpage.

-

Is a gift annuity right for you?

-

A CGA is an irrevocable gift, best suited to donors wishing to support MIT and receive income. Annuitants must be at least 50 years old at the time payments begin.

-

What assets can be used to fund an annuity?

-

You can use cash, securities, or a combination to fund your gift. With a gift of appreciated securities, you will avoid the up-front capital gains tax when you establish your gift.

-

What are the choices for annuity income?

-

You have three options for annuity payments: immediate; deferred to a specific date; or flexible-deferred, in which you can give now and decide later when to initiate payments.

-

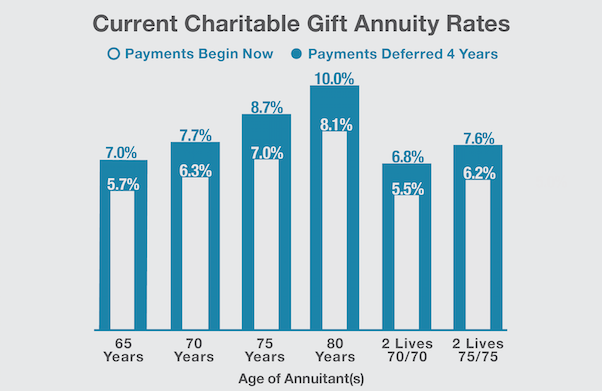

What are the most current charitable gift annuity rates?

-

The American Council on Gift Annuities (ACGA) Board of Directors approved the current maximum rates on November 17, 2023. The new rates took effect on January 1, 2024. MIT gift annuity rates are the current ACGA rates, which can be found on acga-web.org

Deferment may be any length, starting one year from the date of gift. You can see how the current rates could apply to a CGA gift by visiting our Gift Calculator. -

Can I fund a charitable gift annuity with my IRA?

-

As of January 1, 2024, IRA owners aged 70 ½ and older may elect to make qualified charitable distributions (QCDs) totaling up to $53,000* in a single year to fund one or more CGAs. A donor may make multiple split-interest QCDs in a given tax year, subject to the $53,000 cap and must also satisfy certain requirements. However, a donor may take advantage of this provision in only one tax year during the donor’s lifetime. There are several limitations in making this kind of gift, but certain donors may find it satisfies their financial and philanthropic needs and should discuss it with their financial and tax advisors. Contact the Office of Gift Planning to learn more about how you may benefit from this new IRA QCD opportunity.

**This amount will be indexed yearly for inflation starting in 2024.

Charitable Remainder Trusts

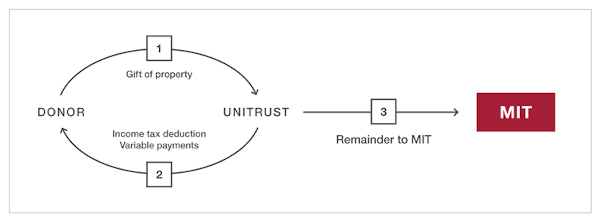

A charitable remainder trust (CRT) enables you to meet financial goals and charitable aspirations.

A CRT is a gift arrangement in which you make an irrevocable gift of $100,000 or more into a trust and establish income for yourself and/or other beneficiaries. At the end of the trust’s term, the remainder becomes available to MIT for the purpose you have selected.

-

Funding a CRT

-

You can give cash, appreciated securities, real property, closely held stock, or any combination of these to create your CRT.

Funding with an IRA QCD: IRA owners aged 70 ½ and older may now elect to establish a CRT with their IRA through a qualified charitable distribution (QCD). Due to the MIT CRT gift minimum of $100,000, a donor and their spouse must each fund the CRT with a one-time gift of at least $50,000 from their respective IRAs in order to meet the minimum. Contact the Office of Gift Planning to learn more about how you and your spouse may benefit from this new IRA QCD opportunity.

-

Two types of tax benefits

-

CRT donors may qualify for an income tax deduction in the year of their gift if they meet the threshold to itemize their deductions, and avoid capital gains tax on the appreciated assets gifted to the trust.

-

Choose the CRT that meets your income needs

-

Unitrust (CRUT). Payments to the donor and/or beneficiaries are equal to 5% of the trust value, determined annually. Once your trust is established, you can add to it with gifts of any amount.

Annuity Trust (CRAT). Provides fixed payments to the donor and/or beneficiaries for the life of the trust. -

Choose your investment strategy

-

Donors may invest their CRT alongside the MIT endowment and share the benefits of its strong long-term performance and diverse portfolio, or they may opt for traditional trust investment with a portfolio tailored specifically to CRTs. All trusts are managed by the MIT Investment Management Company (MITIMCo), a division of MIT.

Investing alongside the MIT Endowment

Investing a charitable remainder trust alongside MIT’s endowment is a unique giving opportunity for donors who want to support the Institute, while benefiting from the growth, diversified portfolio, and low-cost management of a large endowment. The MIT endowment and a CRT share the visionary goals of providing income now while ensuring future financial support for MIT’s mission.

-

The scope of an institutional investment portfolio

-

Pool A, MIT's primary investment pool, is currently invested primarily in equities and heavily weighted toward private equity, real estate, and marketable alternatives, with the goal of maximizing total return relative to appropriate risk. For many CRT donors, the opportunity to access assets commonly unavailable to the individual investor, such as venture capital and hedge funds, is especially appealing.

-

Expert management

-

The MIT endowment, including Pool A, is managed by the MIT Investment Management Company (MITIMCo), a division of MIT. The MIT Office of Gift Planning provides donors and trust beneficiaries with top-quality service for the lifetime of their trust, including delivery of payments and tax documentation.

-

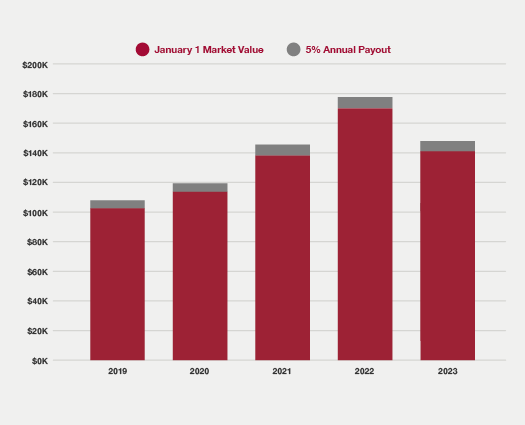

A CRUT invested alongside Pool A

-

The trust illustrated below was established in 2018 with a gift of $100,000 and is providing 5% annual payments for the lifetimes of the donors. Payments from a CRUT may fluctuate depending on fund performance, and past performance is no guarantee of future results. We encourage you to discuss this giving option with your advisors to determine if a CRUT may be right for you.

|

See How These Gifts Can Work For You

Use the gift calculator to help estimate how a charitable gift annuity or charitable remainder trust might benefit you.

Charitable Gift Annuity Disclaimers

THIS IS NOT LEGAL ADVICE. ANY PROSPECTIVE DONOR SHOULD SEEK THE ADVICE OF A QUALIFIED ESTATE AND/OR TAX PROFESSIONAL TO DETERMINE THE CONSEQUENCES OF THEIR GIFT.

For California residents: Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association.

For Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department.

For South Dakota residents: Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance.